How to Record a Credit Memo Journal Entry

1. Introduction

Welcome to this comprehensive guide on how to record a credit memo journal entry. In this article, we will delve into the concept of a credit memo, explain why it is essential to record a journal entry for credit memos, and provide you with step-by-step instructions for accurately recording these entries in your accounting records.

Before we proceed, let’s define a credit memo. A credit memo is a document issued by a seller to a customer, indicating a reduction in the amount owed by the customer. It typically arises when there are errors in billing, returns, or adjustments to the original invoice.

Why Record a Credit Memo Journal Entry?

Recording a credit memo journal entry is crucial for maintaining accurate financial records and ensuring the integrity of your company’s accounting system. By properly recording credit memos, you can reflect the correct financial position and communicate the adjustments made to relevant stakeholders.

Now, let’s explore the steps involved in recording a credit memo journal entry:

2. What is a Credit Memo?

A credit memo is a document issued by a seller to a customer, indicating a reduction in the amount owed by the customer. It serves as a credit note, correcting errors, granting refunds, or acknowledging returns. Credit memos are vital for maintaining transparent and accurate financial transactions.

3. Why Record a Credit Memo Journal Entry?

Recording a credit memo journal entry is essential for several reasons:

- Accuracy: Journal entries ensure that credit memos are properly accounted for in your financial records, maintaining accuracy and integrity.

- Transparency: By recording credit memo entries, you provide transparency to internal and external stakeholders regarding adjustments made to customer accounts.

- Compliance: Properly recording credit memo journal entries ensures compliance with accounting standards and regulations.

4. Steps to Record a Credit Memo Journal Entry

Follow these steps to record a credit memo journal entry:

- Identify the relevant accounts: Determine the accounts affected by the credit memo, such as accounts receivable, sales, or specific product/service accounts.

- Debit or credit accounts: Based on the nature of the credit memo, decide whether to debit or credit the affected accounts.

- Record the journal entry: Use your accounting software or a manual journal entry to record the credit memo, ensuring proper account classification and amounts.

- Include necessary details: Provide a clear description of the credit memo, including the customer’s name, reference number, and any relevant invoice details.

- Review and post: Double-check the accuracy of the journal entry and post it to the general ledger.

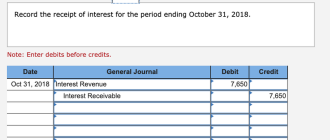

5. Example of a Credit Memo Journal Entry

Here’s an example of a credit memo journal entry:

| Account | Debit | Credit |

|---|---|---|

| Accounts Receivable | – | $500 |

| Sales | $500 | – |

This example demonstrates a credit memo reducing the accounts receivable and sales accounts by $500.

6. Tips for Recording Credit Memo Journal Entries

Consider the following tips to ensure accurate recording of credit memo journal entries:

- Maintain proper documentation: Keep a record of all credit memos issued and the corresponding journal entries for future reference.

- Use consistent account codes: Follow a standardized chart of accounts to ensure uniformity and ease of analysis.

- Reconcile regularly: Reconcile credit memo transactions with customer accounts to identify any discrepancies promptly.

- Seek professional guidance: Consult with an accountant or financial expert if you encounter complex credit memo scenarios.

7. Conclusion

Recording credit memo journal entries accurately is vital for maintaining transparent financial records and ensuring compliance with accounting standards. By following the steps outlined in this guide and implementing the provided tips, you can confidently record credit memos and communicate the necessary adjustments in your accounting system.

Remember, maintaining accurate and reliable financial records is essential for making informed business decisions and fostering trust among stakeholders.

2. What is a Credit Memo?

A credit memo is a crucial document in the realm of accounting and financial transactions. It serves as a means to correct errors, acknowledge returns, or grant refunds to customers. Understanding the concept of a credit memo is vital for maintaining accurate and transparent accounting records. Let’s delve deeper into the key aspects of a credit memo:

Definition

A credit memo, also known as a credit note, is a document issued by a seller to a customer, indicating a reduction in the amount owed by the customer. It acts as a record of the adjustment made to a customer’s account due to various circumstances, such as billing errors, returned goods, or pricing adjustments.

Purpose

The primary purposes of a credit memo are:

- Error Correction: When errors occur in invoicing, such as overcharging or incorrect quantity or price, a credit memo is issued to rectify the mistake and adjust the customer’s account accordingly.

- Returns and Refunds: In cases where customers return goods or request refunds, a credit memo documents the return or refund amount, ensuring proper accounting treatment and accurate financial reporting.

- Adjustments: Credit memos are also used to make adjustments for discounts, allowances, or promotional pricing agreed upon with the customer, reflecting the revised amount owed.

Key Components

A credit memo typically contains the following information:

- Customer Details: The name, address, and contact information of the customer for whom the credit memo is issued.

- Credit Memo Number: A unique identifier assigned to the credit memo for easy reference and tracking.

- Date: The date on which the credit memo is issued.

- Reference: Any relevant reference numbers, such as the original invoice number or purchase order number, associated with the transaction.

- Reason for Issuance: A clear explanation of why the credit memo is being issued, whether it’s an error correction, a return, or a pricing adjustment.

- Amount: The specific amount being credited to the customer’s account.

It’s important to note that credit memos should be properly documented, sequentially numbered, and retained for future reference and audit purposes.

Now that we have a clear understanding of what a credit memo entails, let’s explore the importance of recording a credit memo journal entry in the next section.

3. Why Record a Credit Memo Journal Entry?

Recording a credit memo journal entry is a fundamental practice in accounting that offers numerous benefits and plays a crucial role in maintaining accurate financial records. Let’s explore the reasons why it is necessary to record a credit memo journal entry:

1. Accuracy and Integrity

By recording credit memo journal entries, you ensure the accuracy and integrity of your accounting records. It allows you to properly account for the adjustments made to customer accounts and reflects the true financial position of your business.

2. Transparency and Communication

Recording credit memo journal entries provides transparency and facilitates effective communication with stakeholders. It allows you to clearly communicate and document any adjustments or corrections made to customer accounts, ensuring transparency and building trust with customers, auditors, and other relevant parties.

3. Compliance with Accounting Standards

Properly recording credit memo journal entries ensures compliance with accounting standards and regulations. It allows you to accurately report financial transactions and adhere to established accounting principles, promoting consistency and reliability in financial reporting.

4. Analysis and Decision-Making

Recording credit memo journal entries enables better analysis and decision-making. It provides a comprehensive record of adjustments, returns, and refunds, allowing you to analyze trends, identify patterns, and make informed decisions based on accurate financial information.

5. Audit Trail and Documentation

Credit memo journal entries serve as an essential part of your audit trail and provide necessary documentation for internal and external audits. They demonstrate the proper handling and recording of credit memos, ensuring transparency and compliance with audit requirements.

By recording credit memo journal entries, you enhance the overall financial management and operational efficiency of your organization.

Now that we understand the importance of recording credit memo journal entries, let’s move on to the next section to explore the step-by-step process of recording a credit memo journal entry.

4. Steps to Record a Credit Memo Journal Entry

Recording a credit memo journal entry involves a systematic process to ensure accurate accounting treatment and proper documentation. Follow these step-by-step instructions to record a credit memo journal entry:

- Identify the Relevant Accounts: Determine the accounts that will be affected by the credit memo, such as accounts receivable, sales, or specific product/service accounts.

- Debit or Credit Accounts: Based on the nature of the credit memo, decide whether to debit or credit the affected accounts. This will depend on whether the credit memo represents a reduction in revenue or an adjustment to a liability.

- Record the Journal Entry: Use your accounting software or a manual journal entry form to record the credit memo. Ensure proper account classification and accurately enter the amounts involved.

- Include Necessary Details: Provide a clear description of the credit memo, including the customer’s name, reference number, and any relevant invoice details. This helps in identifying and referencing the credit memo in the future.

- Review and Post: Double-check the accuracy of the journal entry before posting it to the general ledger. Review the amounts, accounts, and descriptions to ensure everything is correct.

By following these steps, you can effectively record a credit memo journal entry and maintain accurate accounting records.

Now that we have covered the steps involved in recording a credit memo journal entry, let’s proceed to the next section to examine an example that illustrates the process.

5. Example of a Credit Memo Journal Entry

To further illustrate the process of recording a credit memo journal entry, let’s examine an example that demonstrates how the entry is recorded:

| Account | Debit | Credit |

|---|---|---|

| Accounts Receivable | – | $500 |

| Sales | $500 | – |

In this example, a credit memo is being recorded to reduce the accounts receivable and sales accounts by $500. The accounts receivable account is credited with $500, indicating a decrease in the amount owed by the customer. At the same time, the sales account is debited with $500 to reflect the reduction in revenue.

It’s important to note that the specific accounts and amounts will vary depending on the nature of the credit memo and your company’s accounting system.

By following the appropriate account classifications and accurately recording the amounts, you can ensure that the credit memo is properly reflected in your financial records.

Now that we have seen an example of a credit memo journal entry, let’s move on to the next section to discover some helpful tips for recording credit memo journal entries effectively.

6. Tips for Recording Credit Memo Journal Entries

Recording credit memo journal entries accurately is crucial for maintaining precise accounting records. Here are some helpful tips to ensure the effective recording of credit memo journal entries:

- Maintain Proper Documentation: Keep a record of all credit memos issued and the corresponding journal entries. This documentation serves as a reference for future audits and reconciliations.

- Use Consistent Account Codes: Follow a standardized chart of accounts to ensure uniformity and ease of analysis. Consistent account codes facilitate accurate classification and identification of credit memo transactions.

- Reconcile Regularly: Regularly reconcile credit memo transactions with customer accounts to identify any discrepancies promptly. This helps maintain the accuracy of the accounting records and ensures that all credit memos are properly accounted for.

- Seek Professional Guidance: In complex credit memo scenarios or situations requiring specialized accounting treatment, consult with an accountant or financial expert for guidance. Their expertise can help ensure compliance with accounting standards and accurate recording of credit memo journal entries.

By following these tips, you can enhance the accuracy and effectiveness of recording credit memo journal entries in your accounting records.

Now that we have explored the tips for recording credit memo journal entries, let’s proceed to the final section to conclude our guide on recording a credit memo journal entry.

7. Conclusion

Congratulations! You have now gained a comprehensive understanding of how to record a credit memo journal entry. Let’s recap what we have covered in this guide:

- Introduction: We began by introducing the concept of a credit memo and its significance in accounting.

- What is a Credit Memo: We explored the definition and purpose of a credit memo, highlighting its role in correcting errors, acknowledging returns, and granting refunds.

- Why Record a Credit Memo Journal Entry: We discussed the importance of recording credit memo journal entries, including accuracy, transparency, compliance, and analysis.

- Steps to Record a Credit Memo Journal Entry: We provided a step-by-step process for recording credit memo journal entries, ensuring proper identification, classification, and documentation.

- Example of a Credit Memo Journal Entry: We examined an example to illustrate how a credit memo journal entry is recorded, showcasing the debit and credit entries for affected accounts.

- Tips for Recording Credit Memo Journal Entries: We offered helpful tips, such as maintaining proper documentation, using consistent account codes, reconciling regularly, and seeking professional guidance when needed.

By following these guidelines, you can accurately record credit memo journal entries and maintain reliable accounting records that reflect the adjustments made to customer accounts.

Remember, recording credit memo journal entries is crucial for transparency, compliance, and informed decision-making in your financial operations.

Thank you for learning with us! If you have any further questions or need additional assistance, feel free to consult with an accountant or financial expert.